Major Export Products

- Home Major Export Product

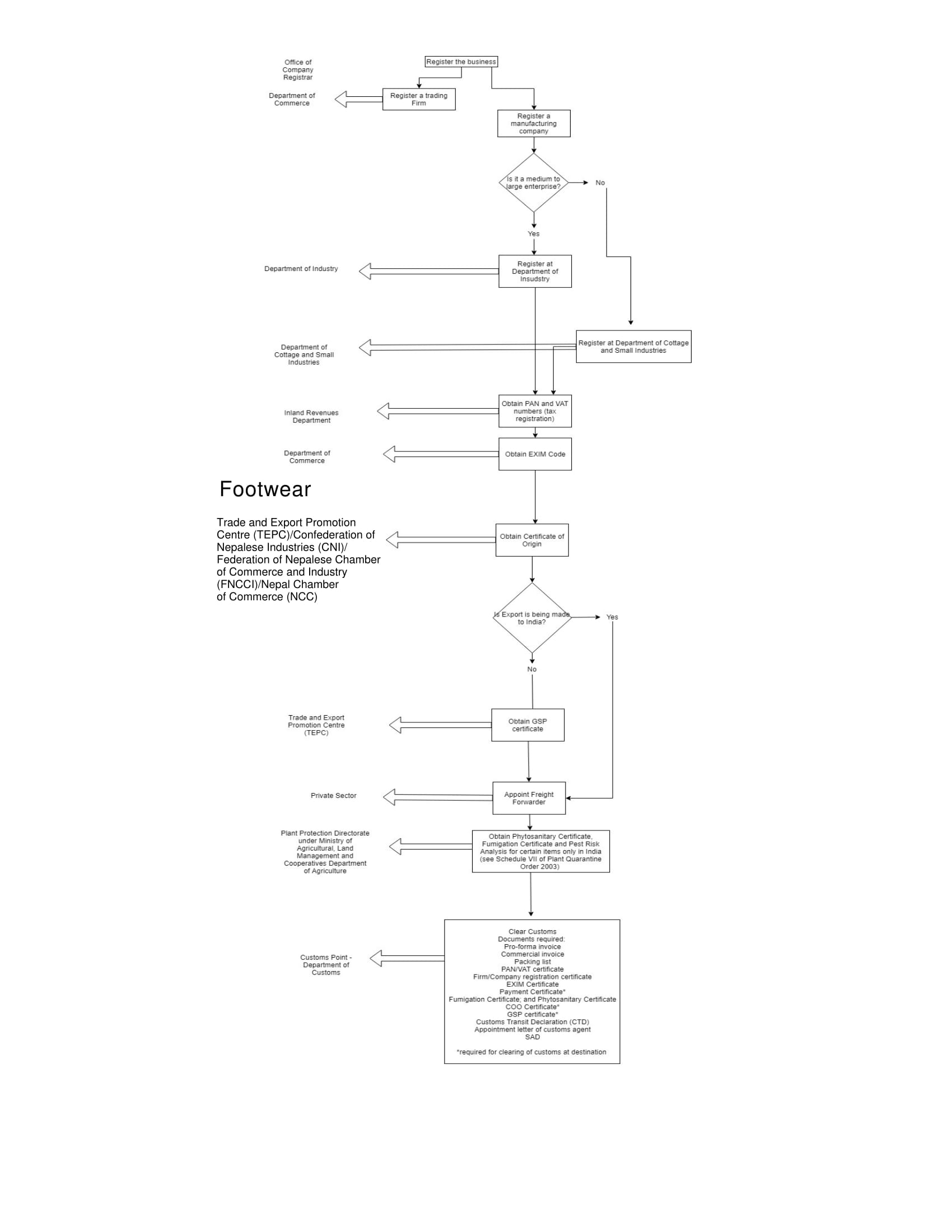

Footwear

Footwear is one of the few industrial sectors currently booming in Nepal. Despite its very recent beginnings, the industry is now currently supplying around 43 percent of Nepal’s domestic demand for footwear. This is despite the fact that footwear like any other apparel and fashion wear is subject to frequent change in customer tastes. While definitive data on total footwear production is not available, some studies suggest that around 12.6 million shoes and other footwear products are produced in Nepal each year.

This sector is providing employment to 60,000 people, of whom 30 per cent are women. Furthermore, about 20 per cent of women are employed in administrative positions. The natural fibre- or felt-based footwear offers more employment opportunities for women.

In contrast to the growing environmental concern in the global footwear market, the Nepalese footwear market has minimum impact on the environment. This is supported by the fact that half of the production process of the Nepalese footwear is manual and consumes minimal amount of electricity. Most of the footwear makers in Nepal produce leather-based shoes and use traditional production methods. While this is highly inefficient and time consuming, this assures the uniqueness and quality amongst the customers. Also, the cut leather pieces are safely disposed of, synthetic cut pieces are recycled, no noise or smoke is emitted and there is minimum water consumption.

The following types of footwear are manufactured in Nepal:

- Footwear with outer soles of rubber or plastic: low price, high volume production and export;

- Footwear with outer soles of leather or composition of leather and uppers of textile materials: medium price, medium volume of production and low volume of export;

- Sports footwear, including tennis shoes, basketball shoes and gym shoes, with outer soles of rubber or plastic: medium price and high volume of production and medium volume of export.

Many varieties of footwear are produced in the country, such as waterproof footwear with outer soles and rubber and plastic uppers, footwear with textile uppers, sports footwear incorporating a protective metal toe-cap or fabric, leather footwear, sandals, canvas shoes having upper cotton parts, footwear incorporating a protective metal toe-cap, footwear covering the ankle but not covering the knee, footwear with upper straps or thongs assembled to the sole by means of plugs, footwear with outer sole of leather and uppers which consist of leather strap across the instep and around the big toe, footwear covering the ankle with outer sole of leather and many others.

Production:

According to Footwear Manufacturers Association of Nepal , annual estimated production capacity of over 30 million pairs. Footwear manufacturing is providing employment to 60,000 employees of which 30 per cent are women. By 2020, the sector is expected to increase annual footwear production up to 45 million and increase the annual export volume over 12 million pairs. Almost all of the footwear manufacturing units are based in Kathmandu Valley.

To find out information on country-specific tariff rates, check International Trade Centre’s MAcMAp. Put Nepal in exporting country field and select the destination country, exporting commodity and year to be exported to find the tariff rate. To find country-specific non-tariff requirements click here.

Trade Statistics

Related Trader

No trader Found

Related Measures and Procedures

Measures

| Name | Type | Agency | Description | Comments | Law | Validity |

|---|---|---|---|---|---|---|

| Certificate of Origin | Formality Requirement | Ministry of Finance | Section 21. Attachment of the documents with the declaration form: (1) A person importing or exporting goods pursuant to Section 18 of the Act, while submitting declaration form to the customs officer, shall submit the following documents including Certificate of Origin. | Comments | Customs Regulation, 2064 (2007) | 9999-12-31 00:00:00.0 |

| Generalized System of Preferences (GSP) | Certificate Requirement | Ministry of Finance | 21. Attachment of the documents with the declaration form:(1) As per section 18 of the Act, the person importing or exporting goods,while submitting declaration form to the customs officer, should submitfollowing documents(a)..(b)...(c) For exportation(1) Invoice(2) Packing list(3) Certificate of Origin(4) Banking document regarding payment procedure, in case of export to third country(5) Documents which are required as per prevailing law regarding the recommendation, license, or certificate from any institution. However Certificate of Origin shall not be mandatory for the export in which G.S.P. certificate is required. | Comments | Customs Regulation, 2064 (2007) | 9999-12-31 00:00:00.0 |

Procedures

| Name | Description | Category | View Procedure Detail with Relevant Forms |

|---|---|---|---|

| Certificate of Origin | Procedure to apply for Certificate of Origin | Procedure | View |

Product Workflow